Commodities in 2026: How the World's Raw Materials Shape Economies, Societies, and the Future

Commodities remain the quiet architecture behind modern life in 2026, underpinning everything from the electricity that powers data centers to the food on supermarket shelves and the metals embedded in smartphones and electric vehicles. As the audience of WorldsDoor explores shifting patterns in health, travel, culture, lifestyle, business, technology, environment, and society, understanding commodities offers a unifying lens through which to interpret many of the world's most pressing developments. Oil prices influence inflation and employment in the United States and Europe, lithium availability dictates the pace of electric vehicle adoption in China and South Korea, and wheat exports shape food security from Africa to Asia. For readers of WorldsDoor Business and WorldsDoor World, commodities are not an abstract financial concept but a tangible force that quietly directs the trajectory of economies and daily life across continents.

At the core of commodities is the notion of fungibility: one standardized unit of crude oil, copper, or wheat can be exchanged for another of the same grade, enabling global markets to operate with speed and efficiency. Yet, behind this apparent simplicity lies a deeply complex system of logistics, regulation, speculation, technology, and geopolitics. In 2026, the global commodities market functions as an early warning system for broader economic shifts, reflecting the impact of climate change, geopolitical tensions, technological disruption, and evolving consumer expectations. For a global readership from the United Kingdom, Germany, Canada, Australia, France, Italy, Spain, the Netherlands, Switzerland, Japan, Brazil, South Africa, and beyond, commodities are increasingly recognized as the connective tissue linking business performance, societal stability, and environmental resilience.

The Evolving Landscape of Hard and Soft Commodities

Commodities are traditionally divided into hard and soft categories, a distinction that remains analytically useful but is increasingly porous in practice. Hard commodities encompass mined or extracted resources such as oil, natural gas, coal, copper, aluminum, gold, silver, lithium, and rare earth elements. Their prices are closely tied to industrial activity, infrastructure investment, technological manufacturing, and energy consumption. Soft commodities include agricultural and livestock products such as wheat, corn, soybeans, rice, coffee, cocoa, cotton, sugar, and beef, whose markets are shaped by weather patterns, crop diseases, dietary shifts, and policy interventions.

In recent years, the interaction between these categories has grown more intricate. The rise of biofuels has bound agricultural markets to energy policy, while the use of agricultural residues in bioplastics and sustainable textiles has connected food systems to manufacturing and lifestyle industries. Similarly, demand for metals such as copper and nickel is now inextricably linked to the global energy transition and the deployment of renewable technologies. Institutions such as the International Monetary Fund and the World Bank regularly highlight how commodity price swings reverberate through inflation, public finances, and social stability, particularly in emerging markets that depend heavily on a narrow range of exports. Readers seeking to understand how these cross-market linkages influence business models and public policy can explore broader economic perspectives through WorldsDoor Business and WorldsDoor Society, where the relationships between markets and communities are examined in an integrated way.

Energy Commodities and the Redefinition of Power

Energy commodities remain central to the global balance of power in 2026, even as the definition of "energy security" shifts from oil fields and gas pipelines to battery metals and grid resilience. Crude oil, refined products, natural gas, and coal still represent a significant share of global energy consumption, with producers in the Middle East, United States, Russia, and Africa shaping market direction through output decisions and infrastructure investments. Organizations such as OPEC and the expanded OPEC+ alliance continue to influence prices through coordinated production strategies, while the International Energy Agency provides forward-looking guidance on demand, investment, and emissions trajectories. Those interested in how global energy projections inform national strategies can learn more about global energy outlooks and connect them to broader geopolitical shifts covered on WorldsDoor World.

Simultaneously, the acceleration of the clean energy transition has elevated materials such as lithium, cobalt, nickel, graphite, and rare earth elements to strategic prominence. These resources are essential for batteries, wind turbines, solar panels, and advanced electronics, placing countries like Chile, Australia, China, Indonesia, and several African nations at the center of new supply chains. This shift has prompted governments and companies to reassess energy security not only in terms of fuel supply but also in terms of mineral access, processing capacity, and recycling infrastructure. Policy reports from the World Bank on minerals for climate action underscore how the race to decarbonize could create new forms of dependency and environmental pressure if not managed with strong governance and community engagement. On WorldsDoor Environment and WorldsDoor Sustainable, readers can explore how the tension between decarbonization and resource intensity is reshaping both environmental policy and corporate strategy.

Metals, Minerals, and the Industrial Backbone of a Digital Age

Industrial metals such as copper, aluminum, zinc, and steel remain the backbone of construction, transportation, telecommunications, and manufacturing, even as the global economy becomes more digital. China continues to be the largest consumer of many base metals, driven by ongoing urbanization, infrastructure development, and green technology deployment, while the United States, European Union, India, and Southeast Asia sustain robust demand through infrastructure renewal and industrial upgrading. The role of copper as a bellwether of economic health-often dubbed "Dr. Copper"-has only intensified, given its critical function in power grids, electric vehicles, and data centers that support cloud computing and artificial intelligence.

At the same time, precious metals such as gold and silver maintain their dual identity as industrial inputs and financial safe havens. Gold, in particular, is closely watched by institutional investors and central banks as a hedge against inflation, currency volatility, and systemic risk. Market infrastructures like the London Metal Exchange and initiatives from the World Gold Council on responsible gold mining illustrate how transparency and sustainability expectations are being integrated into historically opaque sectors. On WorldsDoor Innovation, readers can explore how new technologies-from sensor-enabled mining equipment to AI-driven exploration-are transforming extractive industries, while WorldsDoor Technology examines the downstream impact of these materials on electronics, mobility, and smart infrastructure.

Feeding the World: Agricultural Commodities in a Climate-Stressed Era

Agricultural commodities sit at the nexus of health, culture, lifestyle, and geopolitics, making them particularly relevant to the interdisciplinary focus of WorldsDoor. Grains such as wheat, corn, and rice are central to food security in Asia, Africa, and South America, while soybeans, palm oil, and sugar underpin vast processed food and biofuel industries. Coffee, tea, cocoa, wine, and spices carry significant cultural and economic weight in countries from Brazil and Colombia to Ethiopia, Vietnam, France, Italy, and Spain, shaping local identities and global consumption trends.

However, agricultural systems are under mounting pressure from climate change, soil degradation, water scarcity, and shifting dietary preferences. The Food and Agriculture Organization provides extensive analysis on global food security and climate impacts, highlighting how extreme weather events and changing precipitation patterns are disrupting harvests in key breadbasket regions. These disruptions contribute to volatility in food prices, with direct implications for inflation, political stability, and public health, particularly in low-income countries. On WorldsDoor Food and WorldsDoor Health, readers can trace how supply-side shocks in commodities translate into changes in nutrition, dietary patterns, and culinary culture around the world.

In response, farmers and agribusinesses in regions such as North America, Europe, and Asia-Pacific are increasingly adopting precision agriculture, drought-resistant crop varieties, regenerative practices, and digital tools to optimize yields and reduce environmental footprints. Reports from the OECD on agriculture and food systems transformation illustrate how policy frameworks and innovation ecosystems are being reshaped to support sustainable intensification and rural resilience. These developments align closely with the themes explored on WorldsDoor Environment and WorldsDoor Sustainable, where the intersection of ecology, technology, and livelihoods is a recurring focus.

Financialization, Exchanges, and the Rise of Data-Driven Trading

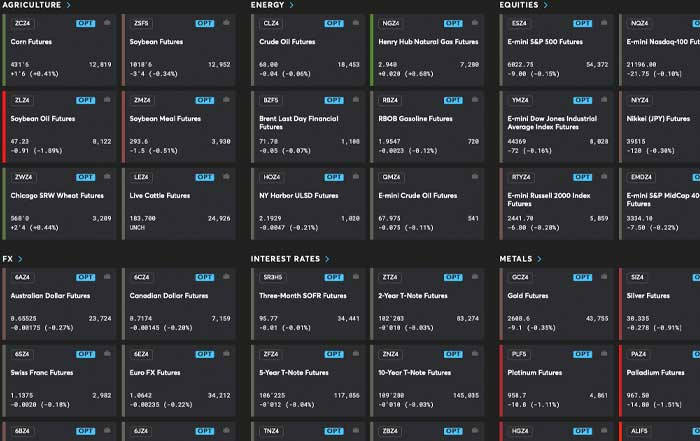

The modern commodities market is as much a financial system as a physical one. Futures, options, and other derivatives traded on exchanges such as the Chicago Mercantile Exchange, Intercontinental Exchange, and Tokyo Commodity Exchange allow producers, consumers, and investors to hedge risks or speculate on price movements. Over the past two decades, institutional participation has grown markedly, embedding commodities more deeply into global financial portfolios and macroeconomic dynamics. Platforms like CME Group offer sophisticated instruments that enable risk management across energy, metals, and agricultural products, while financial indices track broad commodity baskets that influence asset allocation decisions by pension funds and sovereign wealth funds.

This financialization has brought both benefits and challenges. On one hand, deeper liquidity and more advanced hedging tools can help stabilize revenues for producers in Canada, Australia, Norway, Brazil, and South Africa, reducing vulnerability to price shocks. On the other hand, speculative flows can amplify volatility, complicating planning for governments and businesses in both developed and emerging markets. Data providers such as Bloomberg, Refinitiv, and S&P Global now play a central role in this ecosystem, delivering real-time information and analytics that guide trading decisions. For readers of WorldsDoor Technology and WorldsDoor Business, the convergence of finance, data, and commodities is emblematic of a broader trend in which information advantages increasingly determine competitive outcomes.

Sustainability, Ethics, and the New Standard for Commodity Supply Chains

In 2026, sustainability and ethics are no longer peripheral concerns but defining criteria in the valuation and governance of commodities. Consumers in the United States, United Kingdom, Germany, France, the Nordic countries, Singapore, and Japan are demanding greater transparency regarding the environmental and social footprint of the products they buy, from coffee and chocolate to electric vehicles and smartphones. At the same time, regulators are introducing stricter due diligence requirements on issues such as deforestation, forced labor, and conflict minerals, reshaping corporate procurement strategies and trade flows.

Organizations such as the United Nations Environment Programme and the World Economic Forum have advanced frameworks that encourage companies and governments to integrate environmental, social, and governance (ESG) principles into resource extraction and trade. Readers interested in the evolution of these frameworks can explore UNEP's work on resource efficiency and the World Economic Forum's initiatives on responsible sourcing and mining. On WorldsDoor Ethics and WorldsDoor Sustainable, these global debates are contextualized within broader reflections on fairness, accountability, and long-term value creation.

Furthermore, voluntary standards and certifications-from Fairtrade International and Rainforest Alliance in agriculture to industry-led initiatives in mining and energy-are increasingly influential in shaping access to premium markets and investment capital. Large asset managers such as BlackRock and Vanguard continue to expand ESG-screened funds, signaling that sustainability performance is now integral to risk assessment and portfolio construction. For companies operating in commodity-intensive sectors, this shift requires not only compliance but proactive engagement with communities, NGOs, and policymakers to build trust and secure long-term licenses to operate.

Digital Transformation, AI, and the Intelligence Layer of Commodity Markets

Digital transformation has added a powerful intelligence layer to commodity markets, changing how decisions are made from farms and mines to trading floors and policy offices. Satellite imagery, Internet of Things sensors, and remote monitoring systems gather granular data on crop conditions, water levels, stockpiles, and shipping routes, while advanced analytics and artificial intelligence translate these data into actionable insights. Technology firms and data providers such as S&P Global, Bloomberg, and specialized platforms in energy and agriculture offer increasingly sophisticated tools for commodity insights and analytics, enabling stakeholders to respond more quickly to emerging risks.

Artificial intelligence developed by organizations such as Google DeepMind, IBM, and Microsoft is being applied to forecasting models that incorporate economic indicators, weather patterns, transportation constraints, and even news sentiment to anticipate price movements and supply disruptions. These capabilities are particularly valuable in regions vulnerable to climate volatility, such as South Asia, Sub-Saharan Africa, and parts of Latin America, where early warning can mean the difference between manageable adjustment and crisis. For readers of WorldsDoor Innovation and WorldsDoor Technology, this fusion of AI and commodities exemplifies how digital tools can enhance resilience and efficiency, while also raising new questions about data access, algorithmic bias, and market concentration.

Blockchain and distributed ledger technologies are also gaining traction in commodities trading, particularly for high-value or ethically sensitive supply chains. By recording transactions in tamper-resistant ledgers, these systems enable traceability from mine or farm to final product, helping verify claims about origin, sustainability, and labor conditions. Such innovations are being tested in sectors ranging from cobalt and diamonds to coffee and palm oil, often in collaboration with major technology firms and global brands. They align closely with the values explored on WorldsDoor Ethics, where transparency and accountability are recurring themes in discussions of digital transformation.

Climate Risk, Resilience, and the Redesign of Supply Chains

Climate change has moved from a future concern to a present operational risk for commodity supply chains worldwide. Droughts in the United States and Australia, floods in Germany and Thailand, heatwaves in India and China, and storms affecting Caribbean and Southeast Asian shipping routes have all disrupted production and logistics, underscoring the vulnerability of globalized supply networks. Assessments from the Intergovernmental Panel on Climate Change on climate impacts and risk reinforce the message that unmanaged climate change threatens not only ecosystems but also the stability of food, energy, and industrial systems.

Companies and governments are responding by investing in resilience measures such as diversified sourcing, strategic stockpiles, climate-resilient infrastructure, and low-carbon logistics. Insurers like Swiss Re and Munich Re are integrating climate risk into pricing models, influencing investment decisions and the cost of capital for projects in vulnerable regions. International organizations, including the World Trade Organization, are examining how trade rules can support climate adaptation and low-carbon transitions, with resources such as the WTO's work on climate and trade informing policy debates. On WorldsDoor Environment and WorldsDoor World, readers can explore how these structural adjustments shape not only markets but also migration patterns, social cohesion, and political priorities.

Human Stories Behind Commodities: Labor, Culture, and Society

Despite the increasing sophistication of finance and technology, commodities remain deeply human. Millions of miners, farmers, fishers, truck drivers, port workers, and factory employees in Africa, Asia, Latin America, North America, and Europe depend on commodity-linked livelihoods. The history of many commodities-sugar, cotton, rubber, oil, and gold among them-is intertwined with colonization, inequality, and environmental damage, leaving legacies that still shape social and political dynamics today. Addressing these legacies is essential for building a more equitable and sustainable global economy.

Initiatives led by organizations such as Fairtrade International and Rainforest Alliance seek to ensure that farmers and workers receive fair compensation, safe working conditions, and a voice in decision-making processes, particularly in supply chains serving consumers in Europe, North America, and Asia-Pacific. Readers interested in how such initiatives influence daily choices can explore fair trade and ethical consumption and sustainable agriculture and forestry, then connect these themes to lifestyle and cultural discussions on WorldsDoor Culture and WorldsDoor Lifestyle. These stories illustrate how purchasing decisions in one part of the world can affect livelihoods, ecosystems, and cultural traditions in another.

Furthermore, commodities often serve as cultural symbols and anchors of identity. Coffee rituals in Italy and Brazil, tea ceremonies in Japan and China, wine traditions in France and Spain, and street food cultures across Thailand, Malaysia, Mexico, and South Africa all demonstrate how raw materials are transformed into experiences that shape social bonds and local narratives. On WorldsDoor Travel and WorldsDoor Food, these cultural dimensions of commodities are explored as part of a broader inquiry into how people connect with place, heritage, and each other.

Looking Ahead: Innovation, Governance, and Shared Responsibility

The future of commodities in 2026 and beyond will be defined by the interplay of innovation, governance, and shared responsibility. Technological advances in AI, robotics, biotechnology, and renewable energy will continue to reshape how resources are discovered, extracted, produced, and consumed. At the same time, regulatory frameworks at national and international levels must evolve to address emerging risks, from digital manipulation of markets and cybersecurity threats to biodiversity loss and social displacement. Institutions such as the World Trade Organization, G20, United Nations, and OECD are central to these efforts, with initiatives on global trade and sustainability seeking to align economic integration with environmental and social goals.

For the global community of WorldsDoor readers, commodities provide a powerful vantage point from which to understand interconnected challenges across business, environment, technology, society, and culture. Whether one is examining inflation trends in the Eurozone, energy transitions in Asia, agricultural resilience in Africa, or innovation ecosystems in North America, commodities are a recurring thread that links local realities to global dynamics. By engaging with in-depth perspectives on WorldsDoor Environment, WorldsDoor Innovation, WorldsDoor Business, and the broader ecosystem of WorldsDoor, readers can deepen their understanding of how raw materials shape not only markets but also the health, culture, lifestyles, and futures of societies worldwide.

In this sense, commodities are more than tradable assets; they are the material expression of human choices, aspirations, and responsibilities. As the world navigates the twin imperatives of economic development and planetary stewardship, the way societies produce, trade, and consume commodities will be central to determining whether the coming decades are marked by instability and scarcity or by resilience, inclusion, and shared prosperity.